The challenging economic times and the high cost of living are putting more strain on our ability to meet financial obligations. When facing these financial challenges, a logbook loan can be beneficial in helping you meet your needs.

For businesses and individuals, getting a loan from banking institutions could be frustrating due to the lengthy process and extensive requirements.

Before you can get a loan from a bank, you must meet some set conditions to access financing. Banks may require you to:

- 1. Verify your income: You are required to prove that you have some type of stable income.

- 2. Have a guarantor: this is someone who can repay the loan on your behalf.

- 3. CRB clearance: Banks will require you to have a good credit history

- 4. Have collateral: If you are applying for a secure loan, you are required to have an asset that can be used as security against the loan.

You are less likely to be granted approval for an unsecured credit if you are listed with the Credit Reference Bureau (CRB), as you are thought to be at a high risk of default.

Secured loans benefit many people who could not access loans from banks due to failure to meet the set eligibility criteria.

Secured loans are loans that require collateral and include mortgages and home loans, title deed loans, and logbook loans.

Secure loans are easily accessible because the lender takes less financial risk. Your asset acts as security and in case you default, the lender can recoup the losses by seizing your asset.

Logbook Loan

One type of secured loan that is gaining popularity is logbook loans. This type of loan allows you to use your car as security.

By using your car as collateral, you can borrow up to 70% of the value of your car. The good thing about it is that you will continue using your vehicle during the loan period.

There are so many lenders available, that it can be difficult to choose the right institution to approach for a logbook loan.

Different institutions have different interest rates and charges such as valuation fees, therefore it is always good to do your research before taking a loan.

You should normalize asking questions to understand the monthly interest rates and any other services or charges to enable you to choose an option that you can pay back comfortably.

Taking a logbook loan is increasingly becoming the go-to option for those who need quick loans and cannot access loans from traditional financial institutions such as banks.

Why a logbook loan is a good idea?

a) Easily accessible

As logbook loans are becoming more popular, there are many lenders offering loans at favorable interest rates. Therefore, it will not be hard finding a lender who can give you a loan to deal with that emergency as quickly as possible.

The availability of online platforms and mobile applications has made it much easier and more convenient for you to apply for a logbook loan.

b) Flexibility in time and amount

A logbook loan is much more flexible, with a 12 to 36 months repayment period, they have longer repayment periods than some personal loans.

The amount you can borrow is also varied because you can borrow any amount of money based on the value of your car. For example, at Ngao Credit you can access up to Kes.5 million.

The lengthy period allows you time to get your finances in order so that you can repay the loan. Monthly payments make it more manageable to pay the loan.

Logbook loans are flexible in that you can pay the loan earlier with no penalties or extra fees.

c) Low-Interest rates

Because the lender is taking on less risk financially, secured loans generally have lower interest rates than unsecured loans.

You can access logbook loans with interest rates as low as 3.5%. Logbook loan providers such as Ngao Credit offer instant loans at low rates with no hidden fees.

d) Fast

The approval time for getting a logbook loan is usually less than 24 hours, with some institutions going the extra mile to ensure that you get the loan in 6 hours. Traditional financial institutions typically take a few days to process and approve the loan.

In an emergency, a logbook loan can be a quick way out of financial hardship due to the short time it takes to be approved.

e) No need for credit checks

When taking a logbook loan, some lenders disregard credit checks because the loan is secured against your car. The only thing that is required is proof that the car belongs to you and a valuation to estimate its value.

f) Use the money as you see fit.

Another benefit of getting a logbook loan is that you can use the money as you see fit. Some loans from banking institutions come with conditions for use. For example, a bank loan for a business is restricted to only being used for business and not personal matters.

With a logbook loan, there are no limitations on how you spend your money. You can invest the money or take the family on a vacation; the choice is entirely yours.

How To Get A Logbook Loan

STEP 1:

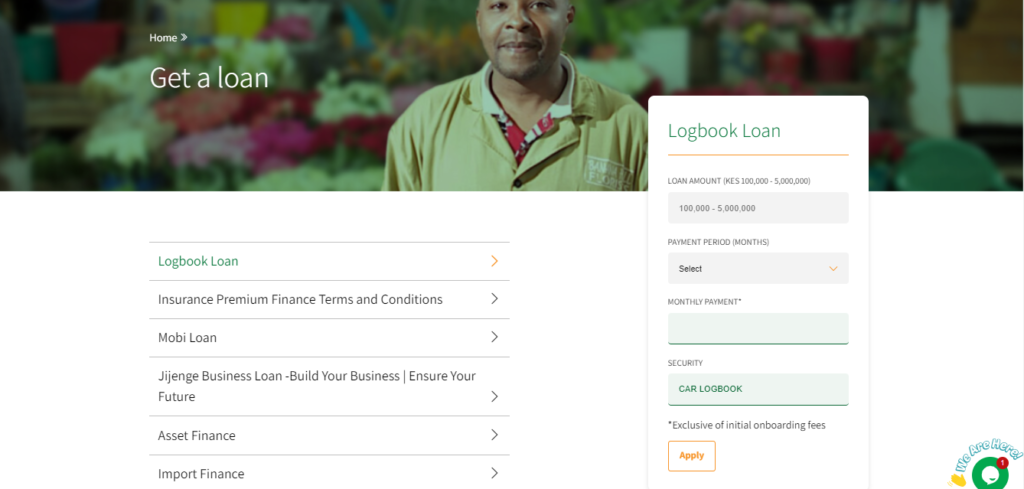

visit our website www.ngaocredit.com. Click Logbook Loans and enter the amount you want to borrow and the duration of the loan in the calculator section. Your monthly payment will be estimated for you by the calculator.

STEP 2:

Click apply and in the pop-up that appears fill in your contact information including name, phone number, and email address.

STEP 3:

Your application will be instantly forwarded to our service center and a customer service officer will call you as soon as possible to answer your queries and guide you through the loan application process.

STEP 4:

Once your loan request has been pre-approved, we will send you our loan agreement to complete, and you will get your money within six hours.

With a logbook loan, you will sort your financial needs instantly while you continue using your vehicle.

Conclusion

When experiencing financial hardships or just looking for cash to deal with emergencies, you don’t have to struggle if you have a car. A logbook loan can be your immediate solution.

All that is required from you is an original logbook to confirm the vehicle is yours, original identification documents, and an up-to-date valuation for your car.

You do not have to wait for a bank to take a lot of time to consider whether to give you a loan or not. If you need fast cash, a logbook loan will get you will get the money fast enough.

At Ngao Credit we strive to ensure that you can access the loan in as low as six hours, so you can deal with your financial situation as fast as possible.

Whether it is a medical emergency, a lucrative investment, or just cash for a long overdue vacation, we are happy to help.

You can access up to 60% of the value of your car anytime.

Looking for a loan, Click below and we will get in touch!